This tax increase applies to accommodations such as hotels, hostels and campgrounds. The effective date of the VAT increase is not yet known. We do see many questions about what this change means and how to configure it in RevControl. Our advice is to ensure that the VAT increase does not affect your profit margin, but to fully pass it on in your room rates. In this blog we explain how to prepare this in RevControl and how to adjust it easily once more information about the effective date becomes available.

Our advice in short

We recommend passing the full VAT increase on to your room rates to maintain profitability. By applying the change now for all reservations in 2026, you ensure that bookings for the coming year are immediately calculated with 12% VAT and therefore priced correctly. As soon as more clarity about the effective date becomes available in the coming weeks, you can adjust the price changes below accordingly. Be aware that some municipalities, such as Ghent, will also adjust the tourist tax in addition to the VAT increase. You set the VAT adjustment in RevControl, while the tourist tax is managed in the reservation system. The prices sent by RevControl are therefore inclusive of VAT and exclusive of tourist tax.

Step by step in RevControl

1. Adjust the Occupancy Based Rate via Minimum Rates

To apply the increase to the Occupancy Based Rate, start by going to the Minimum Rates. These are set per room type or for the entire accommodation.

- Increase the minimum prices by 6% so the VAT increase is fully passed on.

- On top of the Minimum Rates, RevControl adds the Occupancy Supplements based on Forecast.

- Check the Occupancy Supplements. Despite the higher VAT, you want to keep your profit margins at the same level. When you increase the minimum prices by 6%, the VAT increase is fully included in the base price. The Occupancy Supplements are not adjusted automatically. This changes the ratio between the increased minimum price and the supplements. Because the supplements are fixed amounts added to the minimum price, this may cause your margin, the relation between revenue and costs, to shift.

For example, if the minimum price was €100 with a supplement of €20 at 80% Forecast, then after the VAT increase the minimum price rises to €106 while the supplement stays €20. As a result, the supplement represents less relative value. It was previously 20%, but now becomes around 18.9%. The margin at the same Forecast becomes lower. We recommend recalculating the Occupancy Supplements after increasing the Minimum Rates and raising them where needed.

2. Check the Competitor Based Rate

To apply the increase to the Competitor Based Rate, first go to the Rates Table and check whether competitors have already adjusted their prices for 2026.

- Have all competitors applied the VAT increase? Then you do not need to take any action. RevControl will automatically adjust the Competitor Based Rate, including the VAT increase, based on the ranking in the Competitor Index.

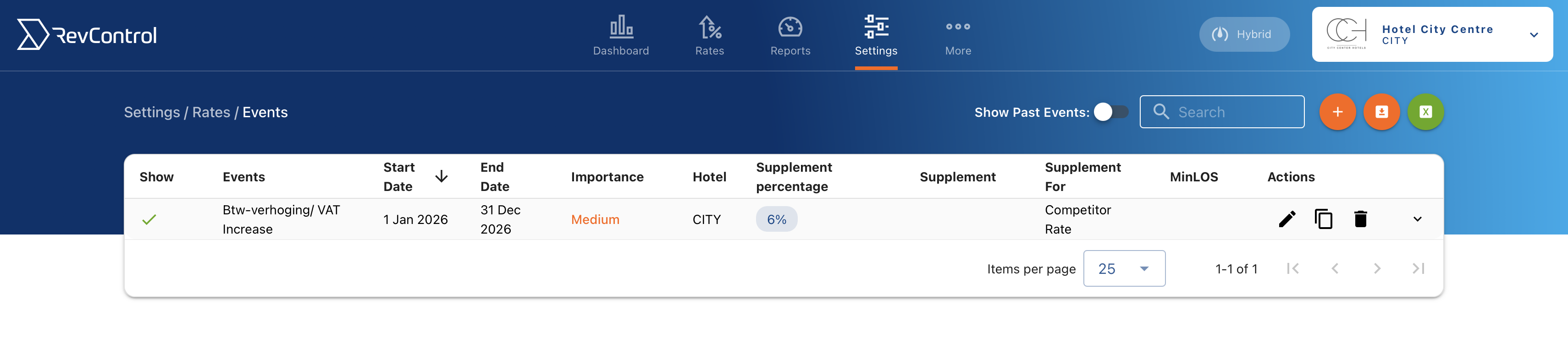

- Are competitors still at the same level? Then create an event for the period from 1 January through 31 December 2026 with a percentage increase and select Supplement for the Competitor Based Rate. Note: The event period can be adjusted at your discretion once there is more clarity about the effective date. In any case, monitor daily how competitors are adjusting their prices for 2026 and lower the percentage of your event as more competitors implement the increase. Once the market has fully followed, you can remove the event.

3. Set an appropriate price ceiling with Maximum Rates

Make sure your maximum rates are correct as well. With support from our Customer Success team, you can activate Maximum Rates. This is a price ceiling that RevControl will not exceed. Increase these by 6%, just like the Minimum Rates.

If the VAT increase is reversed or the effective date changes, you can easily lower the Minimum Rates again and remove the event. By preparing now, you avoid receiving reservations that are still priced with the reduced rate. With the steps above you maintain control over your margins and competitive position. Need some help along the way Our Customer Success team is happy to assist. Send us a chat or an email.